A Guide to Balance Sheets with Template

On the basis of such evaluation, they anticipate the future performance of the company in terms of profitability and cash flows and make important economic decisions. When setting up a balance sheet, you should order assets from current assets to long-term assets. They’re important to include, but they can’t immediately be converted into liquid capital.

Determine the Reporting Date and Period

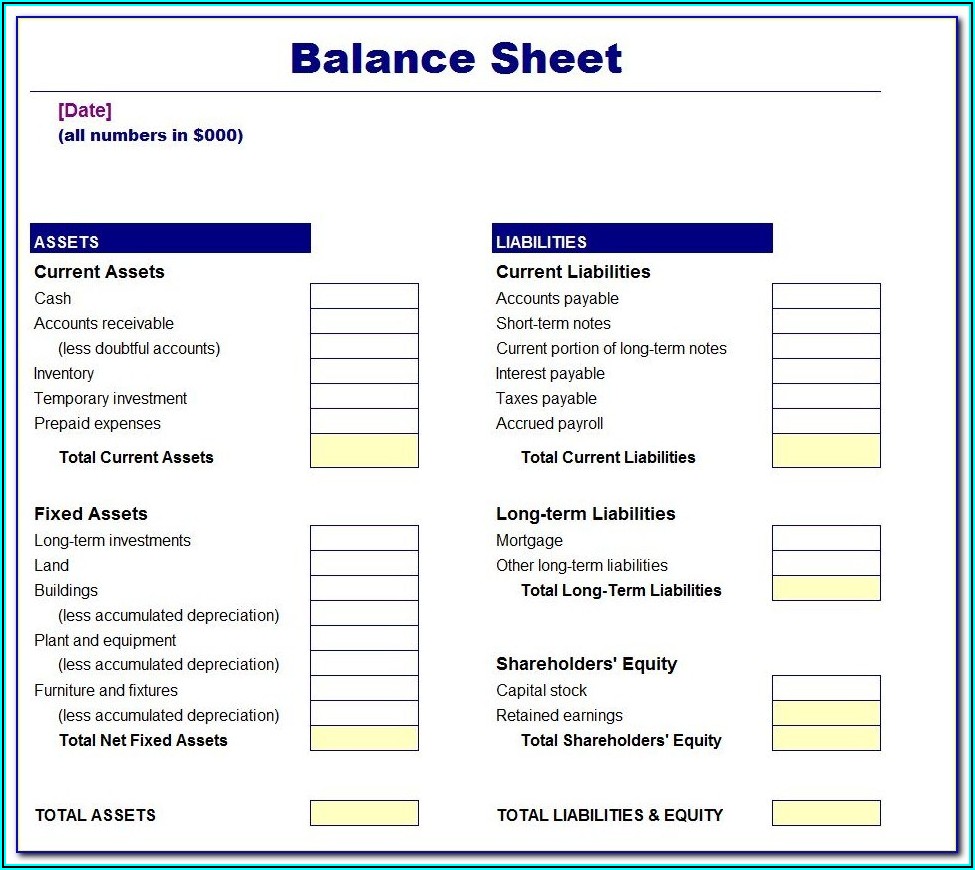

The left column is for listing your assets, with a total of assets at the end of the column. The right column is for listing liabilities, which you total and add to the owners’ equity. When the sum of liabilities and owners’ equity is totalled, the amount should be equal to the total amount of assets in the left column. The term owners’ equity is mostly used in the balance sheet of sole proprietorship and partnership form of business. In a company’s balance sheet, the term owners’ equity is often replaced by the term stockholders’ equity.

What is the balance sheet formula?

Again, these should be organized into both line items and total liabilities. If the company wanted to, it could pay out all what is xero erp and how much does it cost of that money to its shareholders through dividends. However, the company typically reinvests the money into the company.

Identify Your Liabilities

If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity. All revenues the company generates in excess of its expenses will go into the shareholder equity account. These revenues will be balanced on the assets side, appearing as cash, investments, inventory, or other assets. Similar to assets, liabilities are divided into current and noncurrent liabilities. Current liabilities comprise debts that are due within a year, such as accounts payable.

- Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

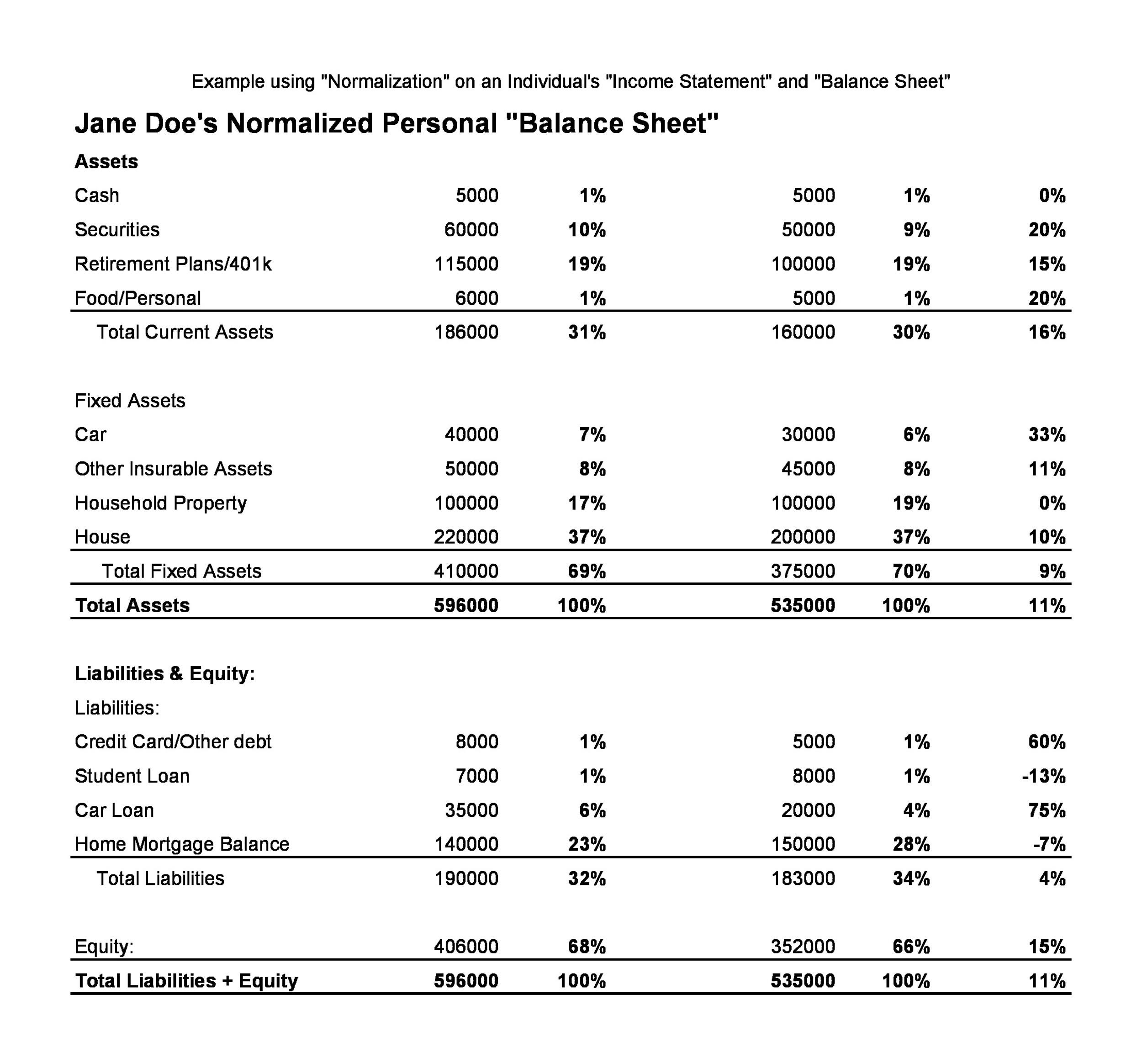

- Here’s an example to help you understand the information to include on your balance sheet.

- Balance sheets are used to determine if a company can meet its debt obligations, while income statements gauge profitability.

- The balance sheet is basically a report version of the accounting equation also called the balance sheet equation where assets always equation liabilities plus shareholder’s equity.

- Like assets, you need to identify your liabilities which will include both current and long-term liabilities.

Balance sheets are one of the most critical financial statements, offering a quick snapshot of the financial health of a company. Learning how to generate them and troubleshoot issues when they don’t balance is an invaluable financial accounting skill that can help you become an indispensable member of your organization. When creating a balance sheet, start with two sections to make sure everything is matching up correctly.

Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet. Shareholder equity is not directly related to a company’s market capitalization. The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price. A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries.

Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt. The remaining amount is distributed to shareholders in the form of dividends. Let’s look at each of the balance sheet accounts and how they are reported. Activity ratios mainly focus on current accounts to reveal how well the company manages its operating cycle. Financial strength ratios can include the working capital and debt-to-equity ratios.

Now that we have seen some sample balance sheets, we will describe each section of the balance sheet in detail. As you can see, the report form is more conducive to reporting an additional column(s) of amounts. Owners’ equity, also known as shareholders’ equity, typically refers to anything that belongs to the owners of a business after any liabilities are accounted for.

A bank statement is often used by parties outside of a company to gauge the company’s health. Shareholder equity is the money attributable to the owners of a business or its shareholders. It is also known as net assets since it is equivalent to the total assets of a company minus its liabilities or the debt it owes to non-shareholders.

Looking for an even simpler way to create balance sheets that support your business? FreshBooks’ free balance sheet template will help you keep track of all the information you need to manage your numbers with ease, helping you to check balances and keep your finances in order. It shows in one place how much the business owns (assets) and owes (liabilities). The report is used by business owners, investors, creditors and shareholders. The current ratio is calculated by dividing the total current assets by the total current liabilities.