Credit Sales Formula + Calculator

Remember, credit sales do not include any sales forfeited due to sales returns, providing a more accurate representation of revenue from sales. Understanding the relationship between net credit sales and the balance sheet helps stakeholders assess the company’s liquidity, creditworthiness, and overall financial stability. Net credit sales refer to the total revenue generated from sales made on credit, excluding any returns, allowances, or discounts offered to customers. Unlike cash sales, where payment is received upfront, net credit sales involve deferred payment, which can affect a company’s cash flow and financial stability. The accounts receivable turnover ratio holds immense importance in assessing a company’s financial well-being. It gauges how effectively a company collects payments from customers who bought on credit.

Ultimate Guide to Calculating Net Credit Sales: Expert Formulas and Real-Life Examples

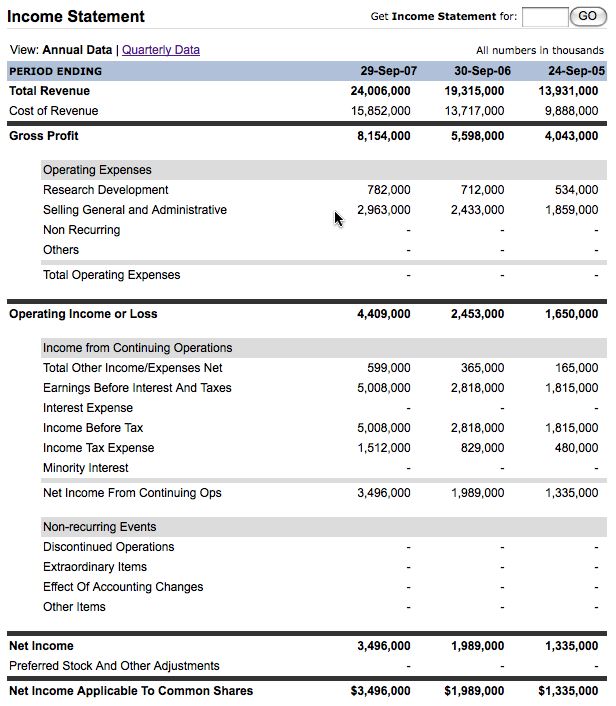

Understanding the relationship between net credit sales and the statement of cash flows helps stakeholders assess a company’s cash flow generation, liquidity, and financial stability. By deducting these factors from the total credit sales, businesses arrive at the net credit sales figure. This represents the actual revenue generated from credit sales, taking into account any adjustments for returns, allowances, and discounts. It reflects the cash inflow that the company can expect to receive from its credit sales transactions. Net credit sales is disclosed in the income statement, which is a financial statement that presents the company’s revenues, expenses, and net income or net loss during a specific period. It also influences other financial statements, such as the balance sheet and statement of cash flows, as it impacts the company’s assets, liabilities, and cash flows.

Finally Ready to Launch a Venture of Your Dream? Apply Business Loans for Veterans TODAY!!

By figuring out this ratio, a company can see how fast it’s turning credit sales into cash, vital for keeping cash flow positive. The income statement helps stakeholders evaluate the profitability and overall financial performance of a company. It also helps in benchmarking the company’s performance against industry peers and identifying areas of improvement. Net credit sales, also known as net accounts receivable sales, is a crucial metric that businesses use to evaluate their performance and make informed financial decisions. It represents the total amount of sales made on credit, minus the amount of returns, allowances, and bad debts.

Gross Sales Vs Net Sales

However, you can also generate revenue from other activities, like the sale of plant machinery, etc. These reasons can include defective goods, excess quantity shipped, wrong items shipped, incorrect product specifications, etc. Charlene Rhinehart where to find net credit sales on financial statements is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. She specializes in creating insightful and impactful content for various industries, including SaaS, Marketing, and IT.

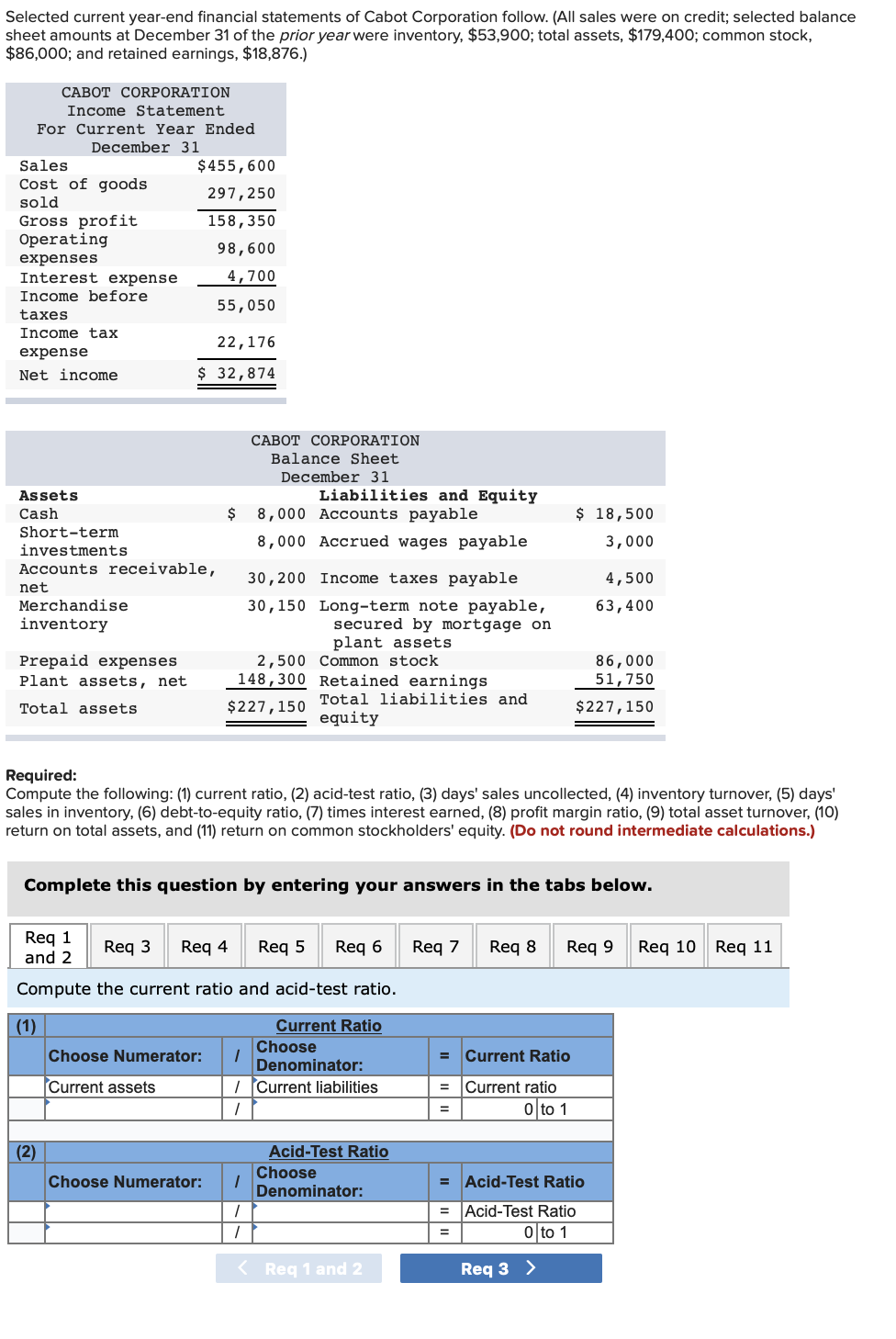

However, while credit sales can be beneficial in attracting customers and driving sales, they also come with certain risks. There is always a possibility that customers may default on their payments, leading to bad debts and potential financial losses for the company. Therefore, it is crucial for businesses to carefully evaluate the creditworthiness of their customers and establish appropriate credit policies and controls. The ABC Enterprise is a furniture selling company that generated $100,000 of gross sales in its most recent month. You’ll also list net credit sales on your profit and loss statements as part of your total sales revenue. That’s because the money customers will eventually pay you after buying on credit is part of your company’s revenue.

Credit Sales Formula

In the following sections, we will explore where net credit sales can be found on financial statements, why it is important, and how it can be analyzed to assess a company’s financial performance. By understanding the significance of net credit sales, investors and other stakeholders can make informed decisions and gain a better understanding of a company’s sales and credit management practices. When sales increase, more credit goes out, affecting timely payment collection. Regularly reviewing the net sales formula helps companies catch any issues with their accounts receivable turnover ratio early, allowing them to fix problems before they escalate. Net credit sales can be defined as the total value of goods or services sold by a company on credit, after deducting any sales returns, allowances, and discounts given to customers. It represents the amount of revenue generated by a business through credit sales, which is an integral component of a company’s overall sales revenue.

Calculating net credit sales would be much easier if cash sales were recorded separately. Net credit sales are revenues made by a company that it extends to consumers on credit, less all sales returns and allowances. Any sales for which money is paid promptly in cash are not included in net credit sales. The gross credit sales metric neglects any reductions from customer returns, discounts, and allowances, whereas net credit sales adjust for all of those factors. Net credit sales also have an impact on the cash flow statement, particularly when customers make payments to settle their credit balances.

The operating profit margin of a company is always determining how the company is growing in its capital. If the operating benchmark is more than 15%, then it is deemed to be a good company with steady growth. Sales returns are the product items that buyers return to you, for various reasons, as a seller to take a full refund of such goods. For example, if you’re a freelance web designer, your customer might pay your final invoice with credit. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

Net credit sales is calculated by subtracting sales returns, allowances, and discounts from the total credit sales. Sales returns refer to the merchandise that is returned by customers due to various reasons, such as defects in the product or dissatisfaction with the purchase. Sales allowances are reductions in the selling price granted to customers as a form of compensation for minor defects or issues with the product. Discounts, on the other hand, are price reductions offered to encourage early payment or to incentivize customers to purchase in larger quantities.

- In other words, it’s the amount of money a business expects to receive from customers for goods or services sold on credit, typically over a specific period.

- On the other hand, if net credit sales decrease, it might indicate a decline in sales or a shift in the company’s sales mix towards cash transactions.

- It’s essential to calculate accounts receivable turnover to understand how quickly a company can collect on its credit sales.

- In the Accounts Receivable Turnover Ratio formula, net credit sales serve as the numerator, representing the total sales made on credit after accounting for returns, allowances, and discounts.

Besides this, net credit sales also indicate the amount of credit you offer to your customers. The average collection period is calculated by dividing total annual credit sales by half the sum of the balance of starting receivables and the balance of ending receivables. The average collection period, as well as the receivables turnover ratio, offer useful insight into assessing the company’s cash flow and overall liquidity.