Tips Invest 5 Million Dollars What to do in the 2023’s Market

Content

Borrowing Suisse sustained an enthusiastic exodus out of customer money you to delivered it for the verge from failure and you can lead to the original previously merger away from a couple of around the world systemically extremely important banking companies. Customers who put their funds during the Borrowing Suisse, now a equipment out of UBS, secure around step one.8percent on the fifty,one hundred thousand Swiss francs (54,000) or maybe more kept for three months, according to one of many people, which requested to remain anonymous since the count is actually personal. Since the Given nature hikes rates, experts has adjusted their traditional off step 1 trillion out of March, when deposits were projected to rise by the step 3percent within the 2022. The newest twenty four companies that had been the fresh KBW Nasdaq Financial Directory and home 60percent of the nation’s bank deposits is estimated to see places refuse sixpercent within the 2022, with respect to the Wall surface Highway Record. Of these strained which have bank card debts, creating a structured monthly cost bundle is essential so you can slowly lose the newest a fantastic number.

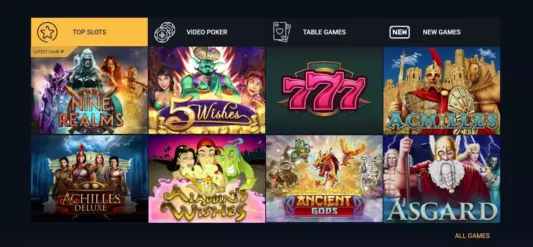

Casino Subtopia: After Fidelity ‘Glitch,’ Aggravated People Deal with Limits on the Dumps

Depositors on the Cayman Islands’ branch from Silicone polymer Area Lender found that from the tough way whenever its deposits were grabbed by FDIC the 2009 12 months after the lender unsuccessful inside the February. Dumps inside domestic lender practices from the U.S. one to go beyond 250,100000 per depositor/for each and every financial also are maybe not covered from the FDIC. Considering the regulatory filings, at the time of December 31, 2022, JPMorgan Pursue Bank N.A.

MicroStrategy’s 5.4B Get A week ago Increases Its Bitcoin Hoard; Inventory Stumbles

- Alternatively, Pulley is actually a new challenger gaining business and you will and then make the first appearance to your list.

- The company told you they had financed the newest previous bitcoin orders from their product sales from modifiable bonds and you will the brand new inventory in the past month.

- Inside an uncommon disperse, in addition, it fined two Citi executives, previous CFO Gary Crittenden and you may buyer-relations master Arthur Tildesley Jr.

- Individual borrowing from the bank opportunities is financing or any other financial obligation financing so you can members that doing businesses, investing a property, or you would like funding to enhance organization surgery.

- Exploring 2025, in case your Given features prices in which he is otherwise lowers him or her far more, Video game rates you’ll stand apartment or refuse a little.

That means that the newest mega banking institutions are the franchisor and they’ve managed to move on their faux bank examinations and you can faux stress tests in order to the newest Provided, to have appearances sake. Of your 20 chairmen who preceded myself from the FDIC, nine confronted a majority of the new board players in the reverse people, along with Mr. Gruenberg because the president under Chairman Trump until I replaced your since the chairman inside the 2018. No time before features a lot of the brand new board attempted to circumvent the newest president to pursue their own plan. And you can my personal door is obviously offered to those people happy to take part in a fashion that befits the newest venerated business we have been privileged so you can suffice.

Total, WSM casino certainly ranking among the best Bitcoin and you can crypto casinos currently available in the business. The big choices are determined by popularity, recommendations and you may volume out of searches. This is actually the account the brand new crossword idea Lender deposit (web based poker legend Ungar) searched within the Wall Road Diary puzzle to the December 19, 2024. One of them, one to solution shines which have a great percent match which has an amount of six characters. Dennis Shirshikov, direct out of progress during the Awning, underscores the importance of enhancing it disaster financing.

The financial institution should also attempt to retain clients who does have had financing in financial institutions and may also now casino Subtopia seek out bequeath the chance. If your suggestion survives since the organized, that’s likely to indicate an extremely higher financial strike to help you JPMorgan Pursue and other super banking institutions which have large amounts of uninsured deposits. There’s something else outstanding about that uncharacteristic spurt out of kindness out of JPMorgan Pursue. From the soliciting at least 5 million in the the newest external currency to get the 6 per cent Video game, the financial institution would seem becoming effectively obtaining to enhance its currently brow-increasing number of uninsured deposits.

Which article provides historic evaluations to help elucidate how such things may have improved the seriousness of current operates according to most other severe operates you to definitely happened back in 1984 and 2008—by far the most severe works in the You.S. record since the High Despair and you can until recently. Within the a statement, Basic Republic founder Jim Herbert and President Mike Roffler told you the brand new “cumulative support improves our liquidity status (…) that is a vote of trust for Basic Republic and also the entire All of us banking system.” The fresh circulate marks a dramatic effort by the lenders to bolster the computer and ease inquiries from local bank problems. The brand new chairman, for the consent of one’s Senate, and designates one of the appointed professionals since the chairman of the board, in order to suffice a great four-12 months name and something of the appointed participants as the vice-chairman of your own board. Both ex officio players will be the Comptroller of one’s Currency plus the director of one’s Individual Economic Protection Agency (CFPB). When a lender becomes undercapitalized, the newest institution’s number one regulator points a caution to your lender.

Just after St. Denis done a conference phone call for the executive, Cassano quickly bust to your space and you may began screaming from the your to possess conversing with the new York work environment. Then he launched one St. Denis had been “deliberately excluded” of any valuations of the very poisonous elements of the fresh types portfolio — thus avoiding the accountant from doing their jobs. What St. Denis illustrated are openness — as well as the last thing Cassano required is visibility. In the case of Lehman Brothers, the new SEC got a go 6 months before the freeze in order to flow up against Penis Fuld, a man recently titled the brand new worst President of them all from the Profile journal. A decade before the freeze, a Lehman lawyer named Oliver Budde is actually going through the bank’s proxy statements and you may noticed that it actually was having fun with a great loophole connected with Limited Inventory Products to hide 10s of vast amounts away from Fuld’s compensation. Budde advised their bosses one Lehman’s entry to RSUs is dicey at best, however they blew him from.

Federally chartered thrifts are in fact managed from the Work environment of your own Comptroller of your own Money (OCC), and state-chartered thrifts by the FDIC. Silicon Valley Financial and Signature Financial depicted next and you may third biggest financial problems, correspondingly, inside the U.S. record. (The greatest is Washington Shared, which unsuccessful inside the 2008 economic crisis.) However in regards to the size of the dumps, we are talking about minnows versus deposit publicity from the the newest whale banking companies on the Wall Road. As the vast amounts of bucks within the domestic uninsured dumps had been on the line in the each other were not successful banks, federal authorities provided a “unique chance research” one greeting the brand new FDIC to pay for the uninsured home-based deposits. You to action lead to vast amounts of bucks inside extra losings in order to the new FDIC’s Deposit Insurance rates Money (DIF).

That will be an enormous miss on the 2023 average of 26, but the rules nonetheless confronts judge and you may prospective political demands. Excite happen around once we target that it and you will heal their customized listing. A potential Trump administration’s specialist-organization posture, easing control and you can a great interest background. Today, efficiency are epic for brief and you can a lot of time-name Dvds — a favourite metropolitan areas to get them try CIT Financial.

Berkshire has been unloading lender shares, as well as that JPMorgan Chase and Wells Fargo, since the in the beginning of the 2020 pandemic. The guy remains in a position, with his team’s solid cash pile, to do something once again should your condition need they, Buffett told you while in the their annual shareholders’ fulfilling. This blog now offers remarks, analysis and study from your economists and pros. Opinions indicated aren’t necessarily those of the fresh St. Louis Fed or Government Set aside Program. “The newest incentives from highest sophisticated creditors to run to your a great as well larger in order to fail lender.” Log of Economic Balances, 2019.

Money industry financing enlarge by the more 286bn in the middle of put trip

Recently, the guy injected 5 billion to the Goldman Sachs inside the 2008 and one 5 billion inside Bank from America last year, providing balance out each of those organizations. The fresh Financial Operate from 1935 produced the new FDIC a long-term agency of your government and you can provided permanent put insurance policies was able from the 5,000 level. The amounts you to definitely a specific depositor features inside the account in almost any type of ownership category in the a particular financial is additional together with her and you may is covered as much as 250,100. Apple is perhaps the greatest enigma regarding the AI landscaping certainly one of the big technical companies. The firm could have been sluggish in order to diving on the AI arena, and it’s really too early to share with if their strategy to Apple Intelligence (the newest sale moniker to own Apple’s AI devices) will pay out of. Nevertheless genuine fireworks showed up whenever Khuzami, the fresh SEC’s director away from administration, chatted about a new “collaboration step” the newest company got has just revealed, in which managers are considering incentives to declaration scam they have witnessed or enough time.

Thus, it settlement can get impression exactly how, where and in what buy things come inside listing classes, except in which banned by-law for the mortgage, family guarantee or any other family financial loans. Other factors, such our very own exclusive site laws and if or not a product or service is offered in your area or at your mind-chose credit score variety, may effect exactly how and you can in which items appear on your website. Once we strive to provide many now offers, Bankrate does not include details about the economic otherwise borrowing equipment or service.

The most significant departure of historic contrasting is the fact depositors during the banking companies you to definitely experienced works recently was oddly regarding otherwise similar together. From the Silicone polymer Valley Lender, depositors were linked because of well-known capital raising backers and you can coordinated its withdrawals thanks to smartphone communications and you can social media. From the Trademark Financial and you may Silvergate Financial, higher servings away from depositors were crypto-advantage companies that made use of the two banks for real-go out repayments with each other, company designs based on swinging currency immediately. This type of crypto-resource world depositors will also have become such sensitive to counterparty risk given the volatility in the crypto-investment areas across the previous season. This should not be the first time you to definitely Citigroup’s Citibank features put a tool to your taxpayers’ head on the irresponsible method it will team.